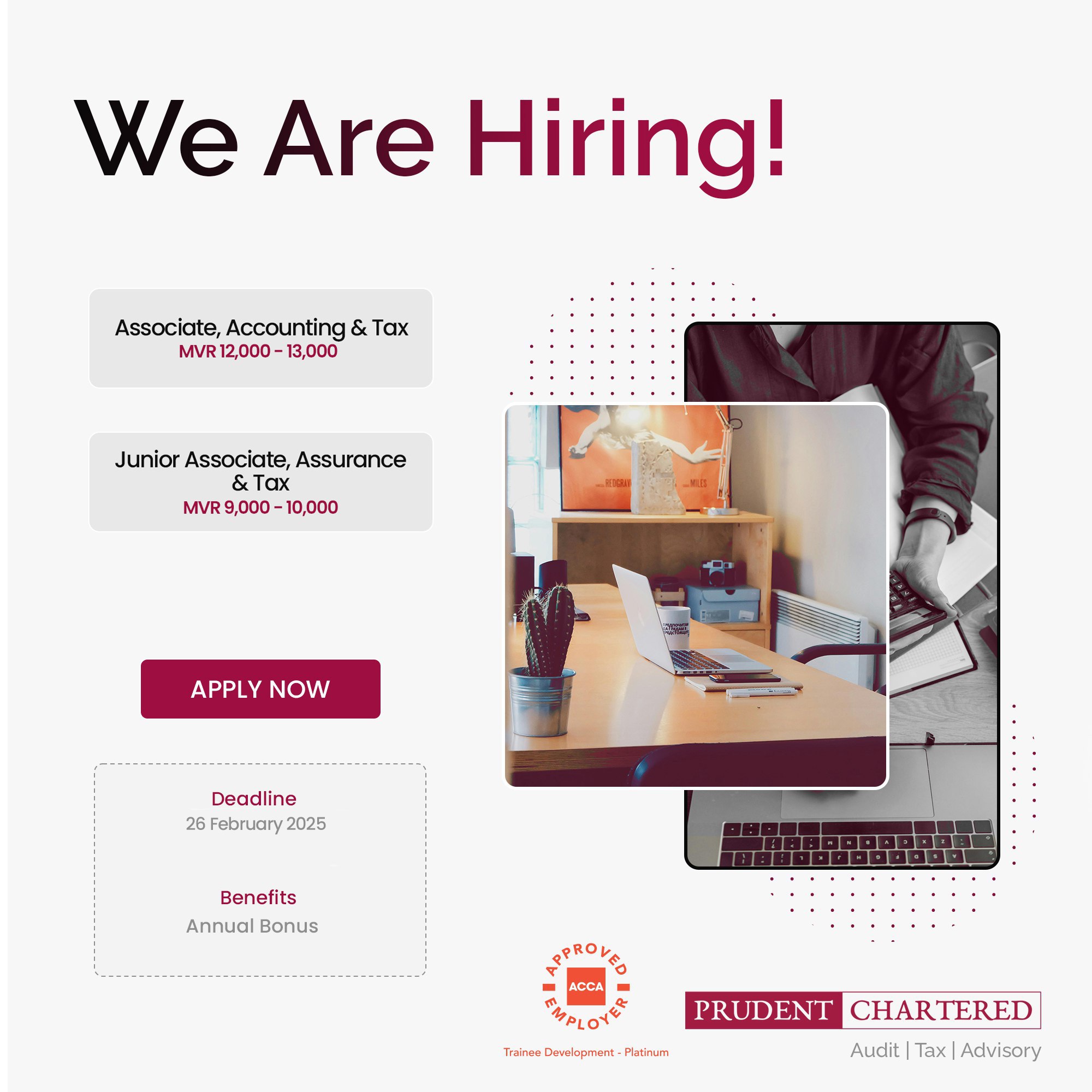

Junior Associate, Assurance and Tax

February 18, 2025

Requirements

Requirements

- Maldivian National

- Completed A level

- No minimum experience required

- Computer literate with working knowledge on Microsoft Office

- Excellent verbal and written communication skills and proficiency in English

- Ability to work independently with multiple priorities and meet challenging deadlines

Job Description

- Assist in planning audit engagements and audit strategies

- Performing audit procedures as per the firm’s audit programs

- Preparing audit working papers and documenting the audit findings

- Performing special assignments such as non-assurance engagements, preparing business plans, etc.

- Overseeing retainer client’s bookkeeping and assist/advise with maintaining accounts

- Preparing and filing of client’s tax returns

- Advising the client on issues pertaining to taxation

Salary and Benefits:

- MVR 9,000 to MVR 10,000 (negotiable based on qualification and experience)

- Bonus (based on firm’s policy)

Official Working Hours:

- Sunday – Thursday (8:30 am to 4:30 pm)

How to Apply:

Interested candidates can submit applications via our Job Application Portal.

Deadline: 26 February 2025

ONLY SHORT-LISTED CANDIDATES WILL BE NOTIFIED!