Income Tax: Director’s Current Account Debit Balances

April 22, 2025

The Maldives Inland Revenue Authority (MIRA) has published an Income Tax Guide on Directors’ Current Account Debit Balances, offering clarity on Employee Withholding Tax (EWT) treatments on certain transactions pertaining to the directors of the companies.

Directors play a crucial role in overseeing the day-to-day operations and governance matters of the organization. In the Maldives, directors of private companies are commonly seen engaging in financial arrangements with the company. These include companies lending money to directors or paying their personal expenses. Additionally, loans provided by directors are among the common financing arrangements observed. For accounting purposes, such transactions are mostly seen recorded in an account that is classified as “Directors Current Account”.

Transactions recorded through directors’ current accounts and other non-monetary benefits to directors have presented certain ambiguities in relation to Employee Withholding Tax. With the recent release of the guidance on Director’s Current Account Debit Balances, the MIRA has provided much-needed clarity regarding the implications of EWT on directors related transactions.

In this article, we look at the said MIRA’s guide.

Loans or advances

When an interest-free or interest below market-rate loan or advance is granted to a director, the financial benefit gained is generally taxable and considered part of the director’s remuneration. The taxable benefits arising due to the loan or advance would be the interest below the market price.

For instance, a director is offered a loan at 6% p.a. interest rate on a MVR 150,000 loan, while the Ordinary Open Market Rate (OOMR) is 15% p.a. The monthly benefit to consider would be MVR 1,125.

If the loan/advance is offered as an interest free loan, the full OOMR should be considered as the annual interest benefit.

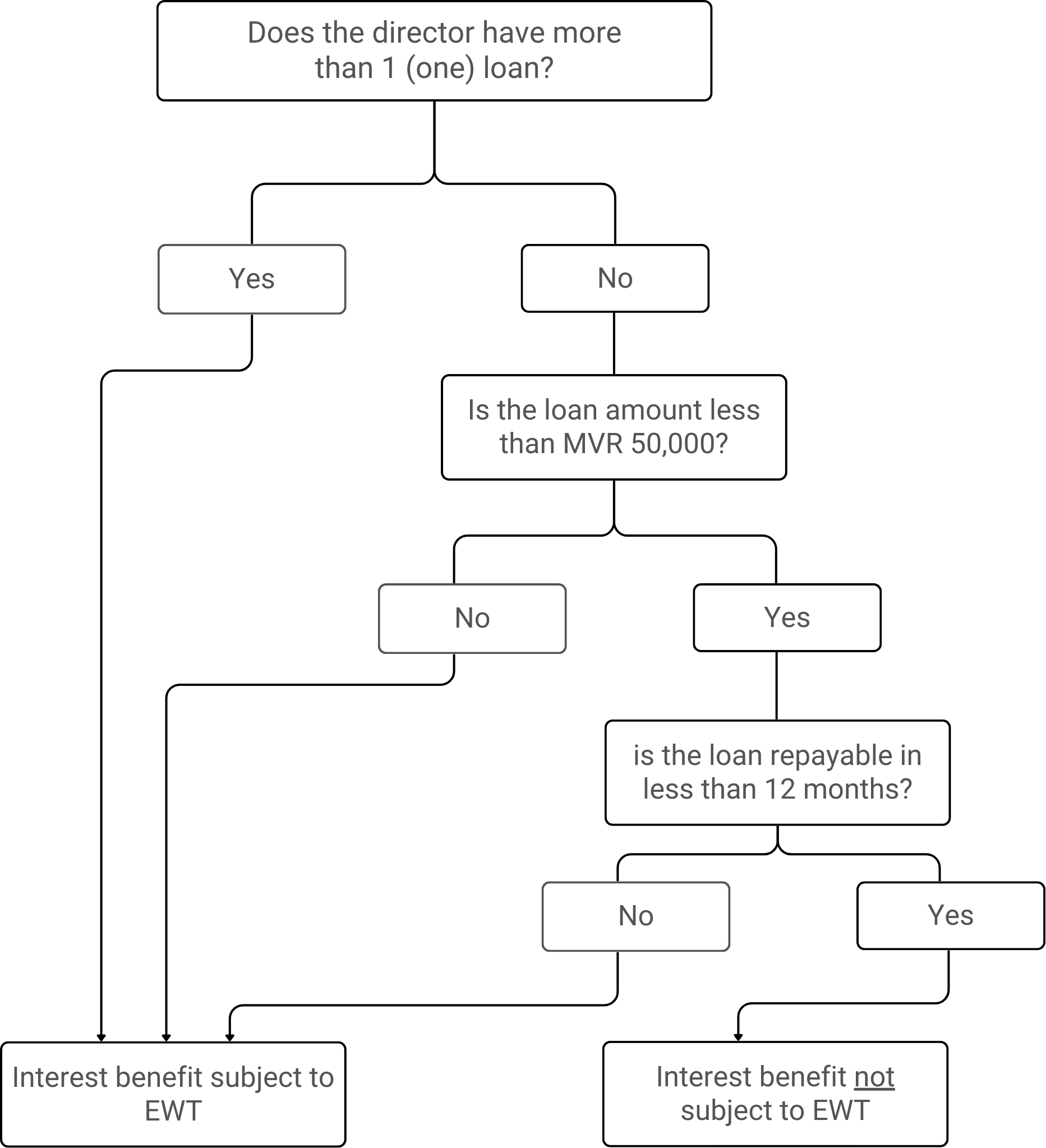

Exemption criteria

Interest from loans and advances is exempted if the following conditions are met.

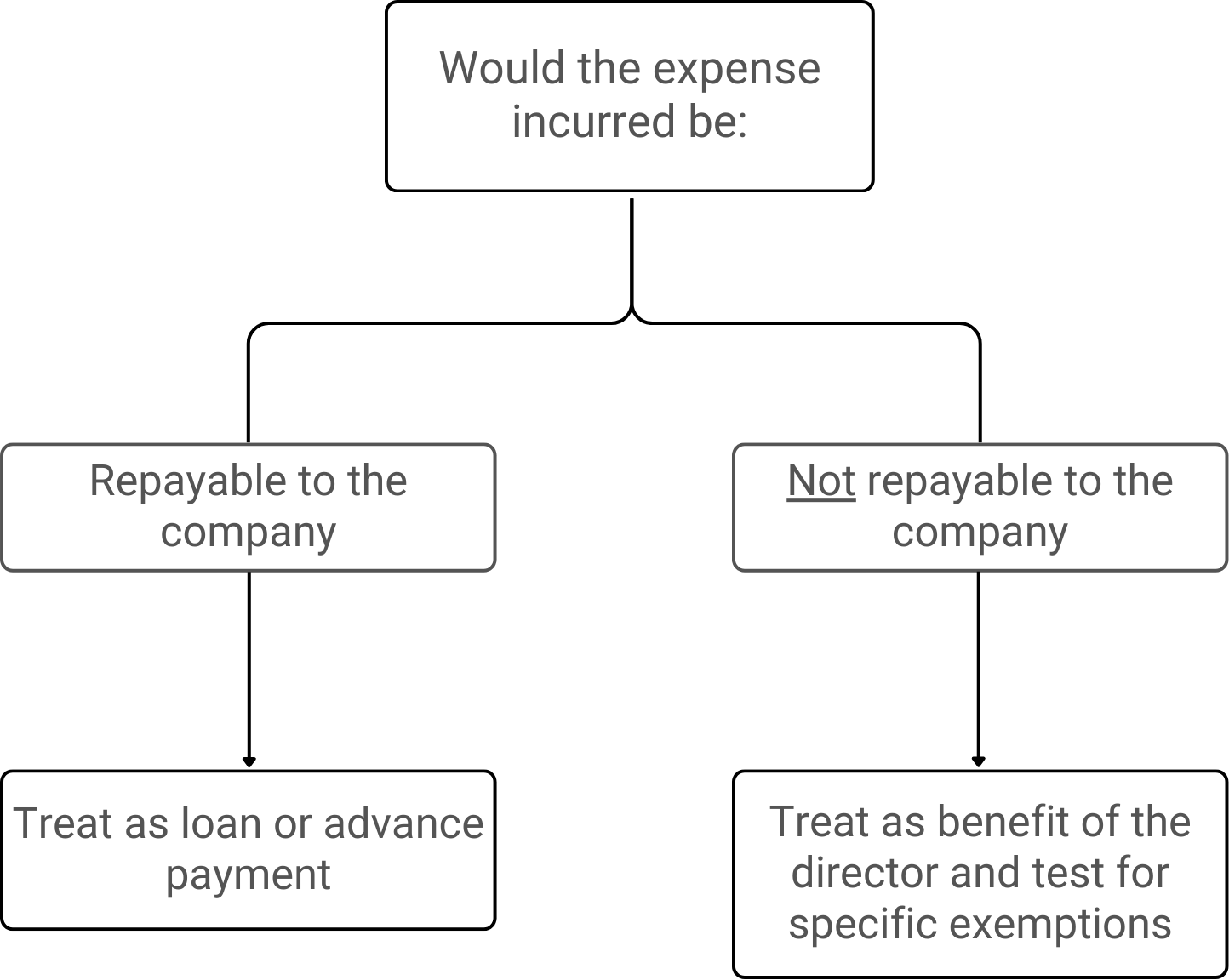

Personal expenses paid by the company

When a director’s personal expenses are paid by a company, the EWT treatment is dependent on whether the amounts are repayable to the company.

Waiver of loans or advances

It is not uncommon for businesses to partially or fully waive off loans/ advances pertaining to the directors. If such a situation occurs, the director should consider the following benefits that would arise.

- Monetary benefit – If a company decides to partially or fully waive the loan or advance, the amount waived should be considered as remuneration paid in money in the month in which the waiver is granted

- Non-monetary benefit – The non-monetary benefit due to a lower interest rate should also be considered up to the date on which the waiver was effected. (Refer discussions under the heading Loans or advances)

Both the financial benefit (interest) and the monetary benefit (waived amount) must be included in the computation of the director’s total remuneration.

Debit balance in the director’s current account

In practice, the director’s current account is an account which is maintained to record the daily transactions between the directors and the company. This will mainly include funds due to the directors and funds taken out by the Directors. These transactions could lead to a debit (director owing to the company) or a credit balance (company owing to the director). Since the interest on loans/advances provided by the company for the director will be a benefit for the director, MIRA considers the debit balance in the company’s books as a loan/advance.

Accordingly, as per the guide, the daily debit balances in a director’s current account should be treated as a loan or advance to the director. Hence, if interest is not charged at the OOMR, the resulting financial benefit to the director must be included as part of the director’s remuneration when computing the monthly EWT liability.

Conclusion

To ensure compliance with EWT rules, proper management of director’s current account balances is crucial. Especially if the director’s current account is used to record short term loan transactions, advances and the personal expense payments made to directors. This can help correctly account for the taxable remuneration by carefully monitoring financial benefits.

Additionally, it is important to stay alert for the cases where interest on advances and loans is exempt. The company should maintain proper documentation to support such exemptions.

It is advisable for employers to seek professional guidance to ensure compliance and mitigate potential risks. If you have any questions relating to EWT and other accounting and tax related matters, please email us at [email protected]

Article Contributors

Eaman Ahmed, Associate

Aminth Leen Lizam, Senior Associate

Hassan Shah, Assistant Director