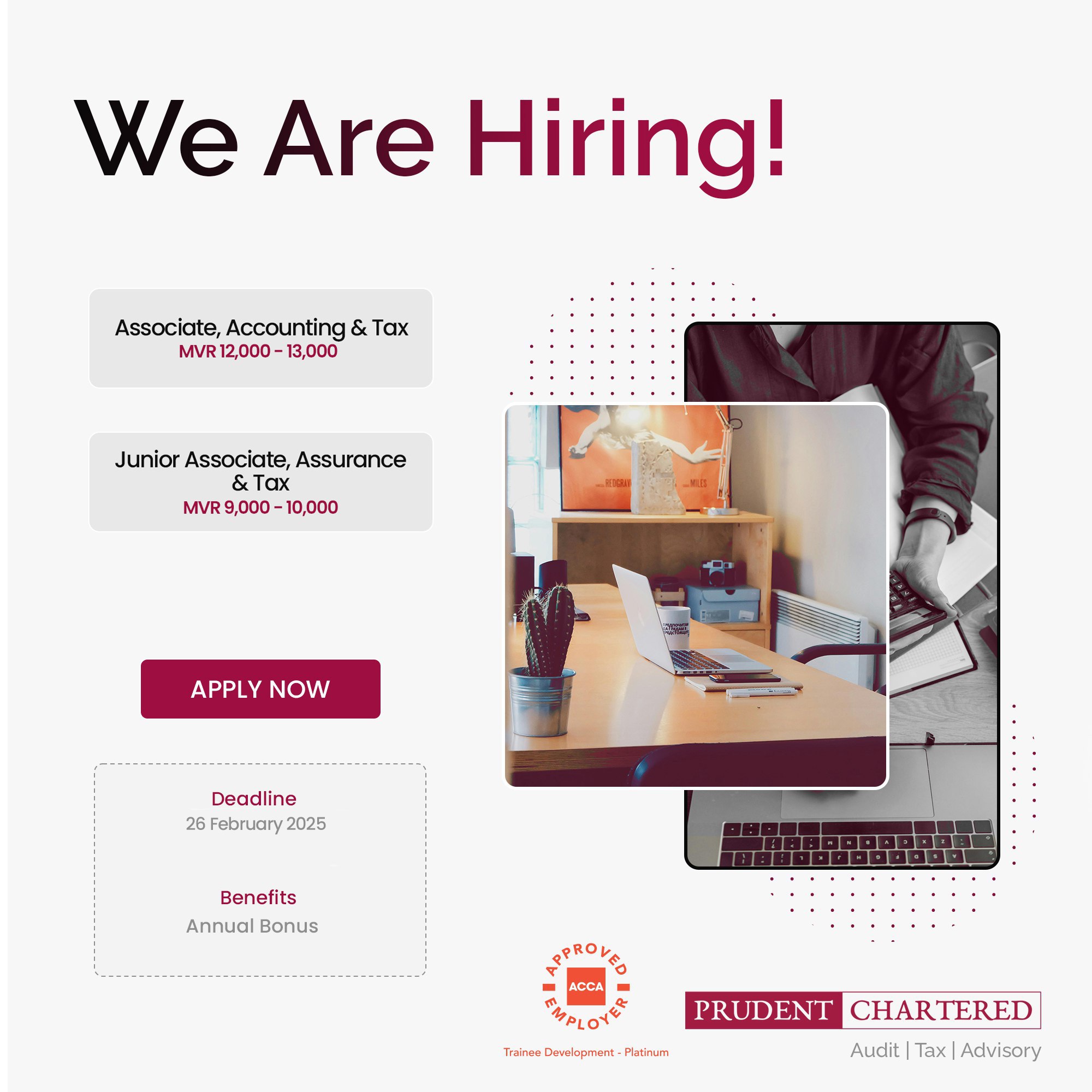

Job Post: Associate, Accounting and Tax

February 18, 2025

Requirements

- Maldivian National

- Completed A Level

- Minimum 1 year experience in a relevant role

- Computer literate with working knowledge on Microsoft Office

- Excellent verbal and written communication skills and proficiency in English

- Ability to work independently with multiple priorities and meet challenging deadlines

- Familiar with accounting software (QuickBooks, Zohobooks etc.) will be an added advantage

Job Description

Client Office Responsibilities:

- Performing bookkeeping of clients

- Conducting bank reconciliations and assist in cash flow monitoring

- Preparing and filing of client’s tax returns

- Assist in preparation of financial statements

- Assist in other accounting related works as directed by supervisor

Audit Firm Responsibilities:

- Performing audit procedures as per the firm’s audit programs

- Preparing audit working papers and documenting the audit findings

- Performing special assignments such as non-assurance engagements, preparing business plans, etc.

Work Location:

- Based in a well-established client office located in Male’ for a set number of days and hours per week; the remaining time will be based at the firm. The staff will be working at the firms full guidance and instructions. This will provide a unique opportunity to experience both client and firm operations.

Salary and Benefits:

- MVR 12,000 to MVR 13,000 (negotiable based on qualification and experience)

Official Working Hours:

- Sunday – Thursday (8:30 am to 4:30 pm)

How to Apply:

Interested candidates can submit applications via our Job Application Portal.

Deadline: 26 February 2025

ONLY SHORT-LISTED CANDIDATES WILL BE NOTIFIED!